In the age of internet of things, user experience has become an art of storytelling much farther away from interface design to creating long lasting impressions at the end user. User driven stories has become the optimal way to pitch to executive decision makers of an organization and clients alike, a one skill that will make us stand out in competition.

In the micro financing Industry, where empowerment and inclusivity matter the most, Merkat Intellekt Technologies Pvt Ltd took a stride that is redefining the landscape. Introducing Credifie, a revolutionary integrated platform designed to uplift female self-help groups in Tamil Nadu through streamlined loan processes. This story of Credifie – emerged from one of our client’s vision and is now embarking on a journey to revolutionize the landscape of micro financing with innovation, efficiency, and empowerment. Merkat Intellekt takes pride in delivering a complete User Centric Agile Design within 2 weeks for Credifie – The Integrated Platform for Micro financing Institutions for Woman Self Help groups.

With our partnership, Credifie has moved from just an idea to a prototype faster and in a more sure-footed manner.

Following are the UX services Merkat Intellekt delivered for Credifie:

- Expert analysis – industry analysis and benchmarking

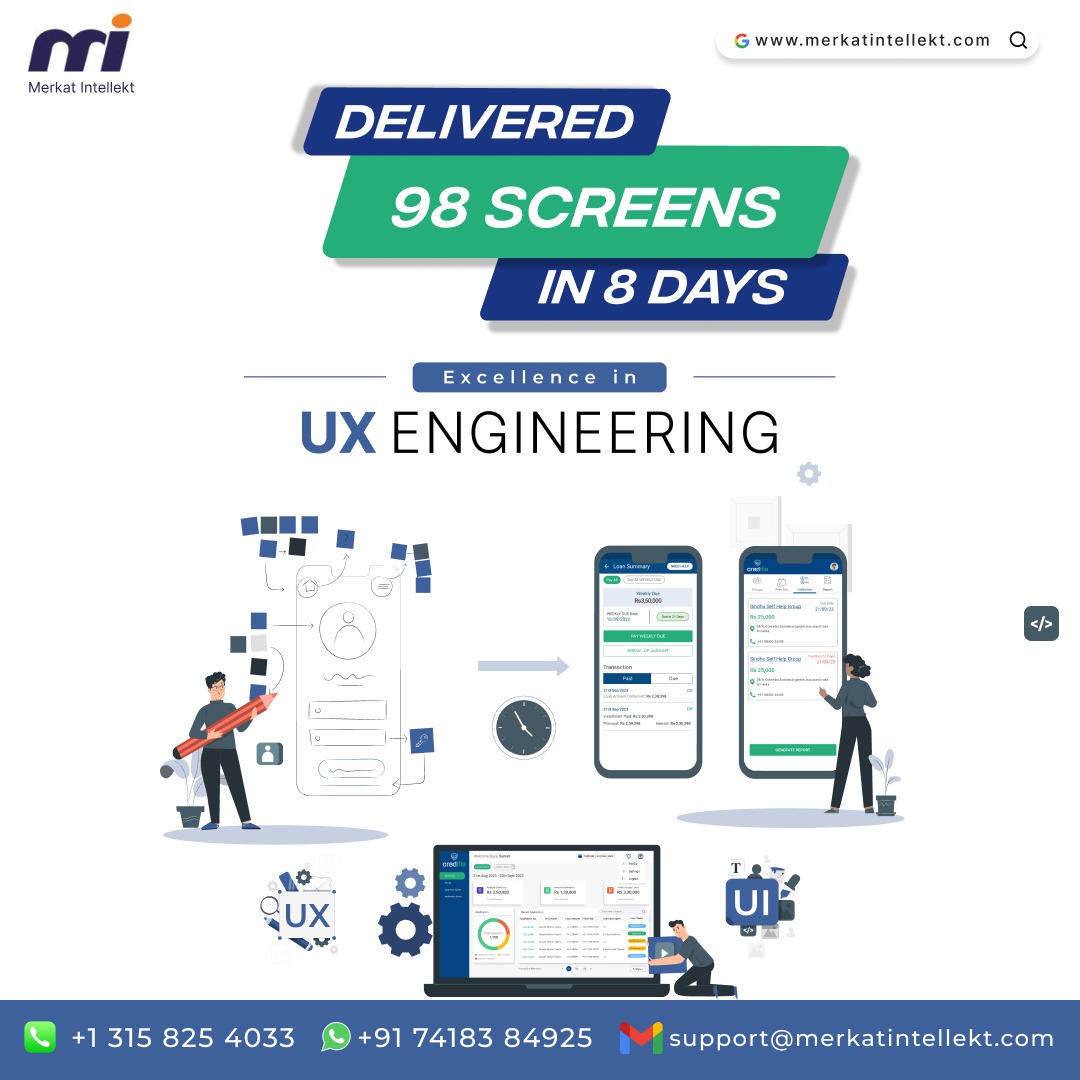

- End-to-end user experience design for Web & Mobile.

- User interface engineering

- A Rapid prototype with responsive design and service design

The Credifie Solution with Merkat Intellekt Advantage: I2IP Model

At Merkat Intellekt, efficiency isn’t just a word; it’s a way of life. The “Innovate to Implement in 60 Days” (I2IP) model, designed for rapid development, was tailored to suit this client’s requirements. Surprisingly, the journey from requirement analysis, UX/UI design, to client presentation for Credifie took just 2 weeks delivering 98 screens across Web & Mobile. The result is a testament to the power of collaboration and streamlined processes.

Credifie isn’t just a static solution; it’s a versatile tool that can be customized to fit various micro financing processes. It has the potential to empower different demographics, address specific challenges, and contribute to the growth of micro financing in diverse contexts. Tailored for micro financing institutions, Credifie empowers them to provide small and medium loans to female self-help groups with unprecedented ease.

Our UX services were focused on delivering the Key Pillars of the platform:

Our UX services were focused on delivering the Key Pillars of the platform:

Web Application for Micro financing Institutions: The beating heart of Credifie, this web application grants micro financing institutions the power to seamlessly process loan applications, manage existing loans, and generate insightful reports. It’s not just a tool; it’s a gateway to efficiency.

Mobile App for Self-Help Groups: With the Credifie mobile app, self-help groups find themselves at the forefront of financial control. They can apply for loans, track existing ones, and make payments, all through a user-friendly interface that puts their needs first.

Mobile App for Loan Collection Employees: Ensuring smooth transactions is vital. Credifie’s mobile app for loan collection employees simplifies loan collection, tracking, and management, fostering a seamless interaction between financial institutions and self-help groups.

Join the Journey:

The Credifie story is an open invitation. As we continue to transform micro financing for the better with our customer, we invite those non-technical founders in the financial industry, who are still struggling to get their ideas into a quick working prototype. If our contribution to Credifie’s impact sounds intriguing, or you wish to explore innovative solutions that matters to the end users, we encourage you to reach out. Let’s begin a dialogue and together, make lasting change a reality.

Initiate the conversation at support@merkatintellekt.com

Conclusion:

Credifie is the embodiment of a client’s need transformed into a tangible solution. As this case study finds its home on our website and echoes through our network, let it serve as a catalyst for discussions, collaborations, and shared visions of a brighter financial future.